What Is a SIC Code?

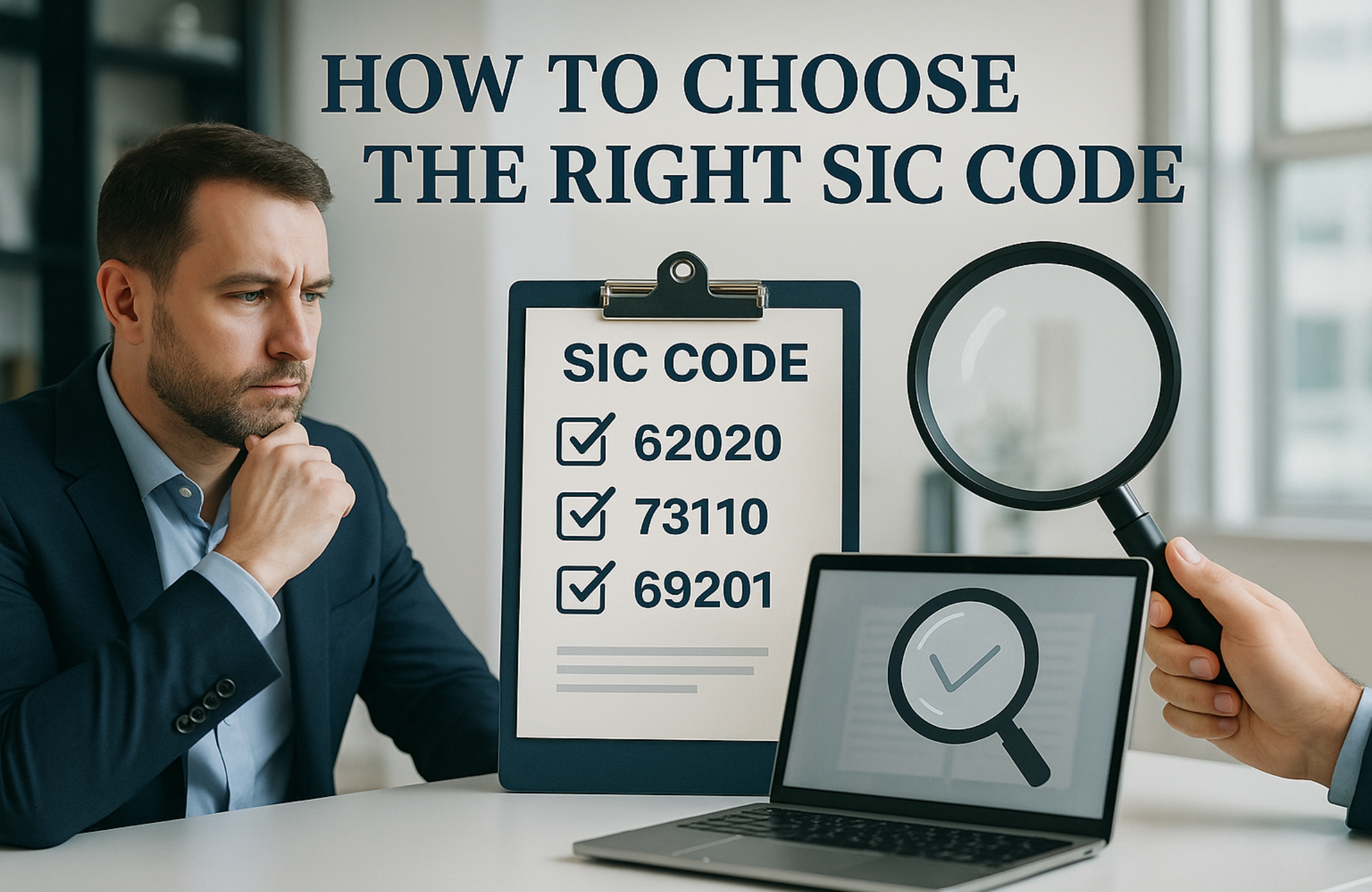

SIC stands for Standard Industrial Classification. It’s a 5-digit code used by Companies House and HMRC to categorise your business activity.

- 62020: Information technology consultancy activities

- 73110: Advertising agencies

- 69201: Accounting and auditing activities

You must choose at least one SIC code when:

- Incorporating a company

- Filing your annual Confirmation Statement (CS01)

You can change your code as your business evolves.

Why Do SIC Codes Matter?

- Help HMRC assess tax treatment and eligibility for reliefs

- Define which regulations may apply to your industry

- Are used in statistical reports and funding applications

- Appear on the public Companies House register

Choosing an incorrect SIC code won’t result in penalties, but it can cause confusion and misrepresent your business.

We help clients select accurate SIC codes based on their core operations and long-term strategy.

How to Choose the Right SIC Code

There are over 600 SIC codes in the Companies House list (based on the 2007 version). To choose correctly:

- Identify your main source of revenue or activity

- Use the official SIC code list from GOV.UK

- If you have multiple activities, choose up to 4 relevant codes

- Select the code that most accurately reflects your core business

If no code seems to fit perfectly, choose the closest match. We help clarify this for clients during formation or CS01 filings.

Multiple Business Activities

You can select up to four SIC codes if your company operates across different sectors. For example:

- A software company offering both IT consultancy (62020) and hosting services (63110)

- A retailer that also provides in-house manufacturing

We help structure SIC code selections to reflect your business accurately without overcomplicating your filings.

Updating Your SIC Code

You can change or update your SIC code:

- By filing your next Confirmation Statement (CS01)

- Or sooner, by submitting an early CS01 with updated information

We handle these updates as part of our registered office or company compliance services, depending on your selected plan.

Frequently Asked Questions

Can I operate outside my SIC code activity?

Yes. SIC codes are primarily for classification—they do not limit your activities, provided they are lawful and within your Articles of Association.

Can I have no SIC code?

No. At least one SIC code is legally required when forming or maintaining a UK company.

Does HMRC use my SIC code for tax decisions?

It may be used for profiling or risk assessment, but it does not determine your tax rates directly. Still, accuracy is important.

Get Your Company Classification Right

Your SIC code is more than just a number—it’s part of how your business is identified by regulators, investors, and public records. Whether you’re forming a new company or updating an existing one, getting it right helps maintain credibility and compliance.

Dragonfly Associates supports clients in selecting and updating their SIC codes as part of our formation and annual compliance services—subject to agreement.

Need help identifying the correct SIC code? Contact our team today.